What is the atom minimum staking for airdrop?

Atom minimum staking for airdrop

The concept of minimum staking for an airdrop varies significantly based on the specific blockchain or cryptocurrency project that is initiating the airdrop.

Airdrops are a popular method for distributing tokens to existing holders or new participants, and they can be used for a variety of purposes, such as increasing network participation, promoting a new project, or rewarding loyal users.

The minimum staking requirements for participating in an airdrop depend on several factors, including the project’s goals, the blockchain’s consensus mechanism, and the level of commitment expected from participants.

In this article, we will explore the different aspects of minimum staking requirements for airdrops and provide insights into how they work within the cryptocurrency ecosystem.

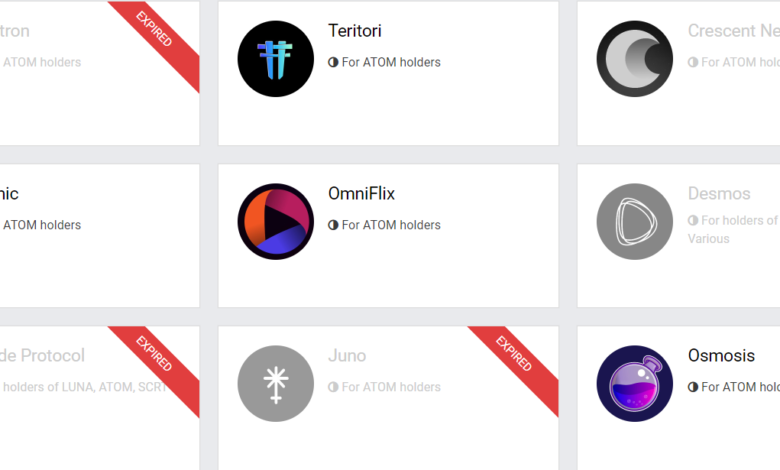

**Atom Airdrops: An Overview**

Before delving into the concept of minimum staking for airdrops, it’s important to understand what airdrops are and why they are conducted in the cryptocurrency space.

Airdrops are a method used by blockchain projects to distribute free tokens to a specific group of participants. These tokens are usually distributed as a promotional strategy, a way to increase network participation, or as a reward for loyal users. Airdrops are often seen as a way to bootstrap a new cryptocurrency project, raise awareness, and create a vibrant community around it.

The distribution of airdrop tokens can take various forms, such as:

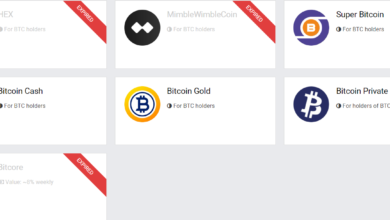

1. **Snapshot Airdrops**: These airdrops are distributed based on a snapshot of a blockchain’s ledger at a specific block height. If you hold a certain amount of a specific cryptocurrency in your wallet at that exact moment, you are eligible to receive the airdropped tokens.

2. **Proof of Stake (PoS) Staking Airdrops**: Many projects opt to reward participants who stake their tokens in the network. Stakers receive a share of newly minted tokens or transaction fees, and sometimes they also receive airdropped tokens.

3. **Participation in Network Activities**: Some airdrops require participants to engage in network activities, such as providing liquidity in decentralized exchanges or participating in governance proposals. These activities often involve staking or locking up tokens.

4. **Random Airdrops**: Some projects distribute tokens to random addresses in a fair and decentralized manner, which does not require any specific actions or minimum holdings.

Each of these airdrop mechanisms has its own set of criteria, and not all of them involve minimum staking. To understand the concept of minimum staking for airdrops, let’s focus on the PoS staking airdrops, which are quite common in the cryptocurrency ecosystem.

**Minimum Staking for Airdrops in Proof of Stake (PoS) Networks**

Proof of Stake (PoS) is a consensus mechanism used by various blockchain networks, including Ethereum 2.0, Cardano, and Polkadot. In PoS, validators are chosen to create new blocks and validate transactions based on the number of tokens they hold and are willing to “stake” as collateral.

Staking is the process of locking up a certain amount of cryptocurrency as collateral to support the network’s operations. In PoS networks, minimum staking for airdrops is often associated with the amount of tokens you hold and are willing to stake.

Here are the key elements to consider when discussing minimum staking for airdrops in PoS networks:

1. **Network-specific Requirements**: Each PoS blockchain project can set its own rules for airdrops. They define how much you need to stake and for how long to be eligible for airdropped tokens. These requirements can vary significantly from one project to another.

2. **Staking Duration**: Some networks might require participants to stake tokens for a specific duration to qualify for airdrops. This period can range from a few days to several months.

3. **Staking Amount**: The minimum amount of tokens to stake varies based on the project’s rules. It can be a fixed number or a percentage of your total holdings.

4. **Participation in Governance**: In some PoS networks, participating in governance activities, such as voting on proposals or running a validator node, can increase your chances of receiving airdrops.

5. **Vesting Periods**: Airdropped tokens may not be immediately accessible and could be subject to vesting periods, during which you can only access a portion of the tokens at a time.

**Examples of PoS Airdrops and Minimum Staking Requirements**

1. **Ethereum 2.0**: Ethereum’s transition to Ethereum 2.0 introduced PoS and staking. To become an Ethereum 2.0 validator and potentially receive airdrops, users need to stake a minimum of 32 ETH. The staked ETH is locked up and used to secure the network.

2. **Tezos (XTZ)**: Tezos is a PoS blockchain that often conducts airdrops to its stakers. To participate in Tezos staking and receive potential airdrops, users can stake any amount of XTZ tokens.

3. **Cardano (ADA)**: Cardano is another PoS blockchain known for its airdrops. While there is no specific minimum amount required to stake ADA, the more ADA you stake, the greater your potential rewards from staking and airdrops.

4. **Polkadot (DOT)**: Polkadot’s PoS network requires validators to bond DOT tokens as collateral. This is not an airdrop in the traditional sense, but it is a mechanism that indirectly affects the rewards and participation in the network.

**Risks and Considerations**

Participating in minimum staking requirements for airdrops comes with certain risks and considerations:

1. **Locking Period**: When you stake your tokens, they are often locked up for a specified period. During this time, you might not be able to access or sell your staked tokens. Make sure you are comfortable with the lockup period before participating.

2. **Network Risk**: The success and security of the network you’re staking in can impact the value of your investment. It’s important to research the project thoroughly and understand its risks and potential rewards.

3. **Minimum Amount**: The minimum staking requirements can vary widely. Some networks may require substantial investments, while others have lower barriers to entry. Consider how much you’re willing to stake and the potential rewards in proportion to your investment.

4. **Airdrop Amount**: Not all airdrops are created equal. Some airdrops distribute a significant amount of tokens, while others offer only a small reward. Ensure that the potential airdrop is worth the staking commitment.

5. **Tax Implications**: Depending on your jurisdiction, staking and receiving airdrops may have tax implications. It’s essential to consult with a tax professional to understand how these activities affect your tax liabilities.

**Conclusion**

Minimum staking for airdrops is a concept that primarily applies to Proof of Stake (PoS) blockchain networks, where participants are required to stake a certain amount of cryptocurrency to be eligible for airdropped tokens.

The specific requirements for minimum staking vary from one project to another, including the amount to stake, staking duration, and participation in network activities.

I loved you even more than you’ll say here. The picture is nice and your writing is stylish, but you read it quickly. I think you should give it another chance soon. I’ll likely do that again and again if you keep this walk safe.

startup talky I like the efforts you have put in this, regards for all the great content.

La weekly I appreciate you sharing this blog post. Thanks Again. Cool.

Mygreat learning This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?