The Ever-Evolving Landscape of Cryptocurrency Exchanges

Introduction

The world of cryptocurrency exchanges is a dynamic and rapidly evolving space, with constant developments and innovations shaping the way individuals and institutions trade digital assets. In this article, we will delve into the latest news and trends surrounding cryptocurrency exchanges, exploring key updates, regulatory changes, technological advancements, and the overall state of the market.

Regulatory Developments

One of the most significant factors influencing the cryptocurrency exchange landscape is the regulatory environment. Governments around the world are grappling with the challenge of regulating digital assets, and their approaches vary widely. In recent months, several countries have made notable strides in clarifying and formalizing their stance on cryptocurrency exchanges.

The United States, for example, has been actively working on a regulatory framework for the crypto industry. The Securities and Exchange Commission (SEC) has been increasing its scrutiny of the sector, with a focus on investor protection and market integrity. Simultaneously, the Commodity Futures Trading Commission (CFTC) has been working on regulating cryptocurrency derivatives.

In Europe, the European Union has proposed a comprehensive regulatory framework for cryptocurrencies, aiming to create a legal and regulatory framework that fosters innovation while ensuring consumer protection. This initiative, known as the Markets in Crypto Assets (MiCA) regulation, could have far-reaching implications for cryptocurrency exchanges operating in the EU.

Asia, a crucial market for cryptocurrency trading, has seen diverse regulatory approaches. China has maintained a strict stance against cryptocurrency trading, leading to the closure of several domestic exchanges. On the contrary, countries like Japan and Singapore have embraced digital currencies, implementing regulations to provide a clear legal framework for exchanges.

Technological Advancements

The technological landscape of cryptocurrency exchanges is continually evolving to meet the increasing demands of users for efficiency, security, and ease of use. Some notable technological trends are reshaping the industry.

Decentralized Finance (DeFi) continues to gain momentum, with decentralized exchanges (DEXs) playing a prominent role. These platforms operate without intermediaries, allowing users to trade directly from their wallets. The rise of decentralized exchanges is challenging traditional centralized exchanges, prompting them to explore ways to integrate DeFi features or enhance their existing infrastructure.

Layer 2 solutions, such as rollups and sidechains, are becoming increasingly popular as a means to address scalability issues on blockchain networks. These solutions aim to improve transaction throughput and reduce fees, providing a more efficient trading experience for users.

Non-Fungible Tokens (NFTs) have exploded in popularity, and several cryptocurrency exchanges are now integrating NFT marketplaces into their platforms. This move allows users to trade digital assets beyond traditional cryptocurrencies, adding a new dimension to the exchange ecosystem.

Institutional Involvement

Institutional adoption of cryptocurrencies and participation in cryptocurrency exchanges have witnessed a significant uptick. Traditional financial institutions, hedge funds, and corporations are increasingly entering the space, contributing to the maturation of the cryptocurrency market.

Major financial institutions are offering or exploring cryptocurrency trading services, providing their clients with exposure to digital assets. This growing institutional interest has led to an influx of capital into the cryptocurrency market, further legitimizing the industry.

Cryptocurrency exchanges are responding to this trend by developing institutional-grade trading infrastructure. This includes features such as over-the-counter (OTC) trading desks, high-frequency trading capabilities, and advanced security measures to cater to the specific needs of institutional clients.

Security Measures and Concerns

Security remains a top priority for cryptocurrency exchanges, given the prevalence of hacks and cyber threats. Exchange operators are continually enhancing their security measures to protect user funds and maintain trust in the ecosystem.

Multisignature (multisig) wallets, which require multiple private keys to authorize a transaction, are increasingly being adopted by exchanges to add an extra layer of security. Cold storage solutions, where private keys are stored offline, are also becoming more prevalent to mitigate the risk of online hacking attempts.

However, the industry is not without its challenges. Despite enhanced security measures, there have been instances of major exchanges falling victim to cyber attacks. This highlights the need for constant vigilance and the development of cutting-edge security protocols to stay one step ahead of malicious actors.

User Experience and Interface Innovations

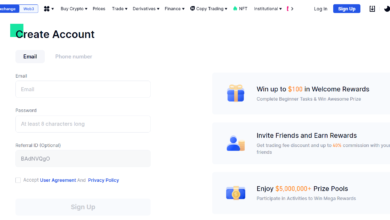

As competition among cryptocurrency exchanges intensifies, user experience and interface design are becoming key differentiators. Exchanges are investing heavily in creating intuitive, user-friendly interfaces to attract and retain traders.

Mobile trading apps are gaining prominence, allowing users to trade on the go and manage their portfolios from the convenience of their smartphones. User interfaces are being optimized for simplicity, ensuring that even novice traders can navigate the platform with ease.

Furthermore, exchanges are integrating advanced charting tools, real-time market data, and educational resources to empower users with the information they need to make informed trading decisions. Social trading features, where users can follow and replicate the trades of successful traders, are also on the rise, democratizing access to trading strategies.

Conclusion

The world of cryptocurrency exchanges is a vibrant and ever-changing ecosystem, shaped by regulatory developments, technological advancements, institutional involvement, security measures, and user interface innovations. As the industry continues to evolve, it is essential for participants, whether novice retail traders or seasoned institutional investors, to stay informed about the latest trends and news shaping the market.

While challenges persist, the ongoing developments in the cryptocurrency exchange space underscore the growing acceptance and integration of digital assets into the broader financial landscape. As the industry matures, it is likely that further innovations and regulatory clarity will contribute to a more robust and secure environment for cryptocurrency trading.

Hi, great post There is a problem with your website on Internet Explorer. Despite being the most popular browser, many people will not be able to view your excellent work because of this issue.

Hello i think that i saw you visited my weblog so i came to Return the favore Im trying to find things to improve my web siteI suppose its ok to use some of your ideas

This entrance is unbelievable. The splendid substance displays the distributer’s dedication. I’m overwhelmed and anticipate more such astonishing entries.

This site is fabulous. The radiant material shows the publisher’s enthusiasm. I’m dumbfounded and envision more such astonishing material.

It seems like you’re repeating a set of comments that you might have come across on various websites or social media platforms. These comments typically include praise for the content, requests for improvement, and expressions of gratitude. Is there anything specific you’d like to discuss or inquire about regarding these comments? Feel free to let me know how I can assist you further!

Thank you for reaching out! If you have any specific questions or topics in mind, please feel free to share them, and I’ll do my best to assist you. Whether you’re curious about a particular technology, scientific concept, literary work, or anything else, I’m here to provide information, advice, or engage in a discussion. Don’t hesitate to let me know how I can help you further!

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers.

dolorum velit at unde qui eveniet consequuntur sed non praesentium sed aliquam a. debitis perspiciatis ex dolores qui temporibus mollitia ut reiciendis dolor ea ipsum et minima ad fugiat et cum.

Hi i think that i saw you visited my web site thus i came to Return the favore Im attempting to find things to enhance my siteI suppose its ok to use a few of your ideas.

aspernatur ducimus alias eius vitae quia et adipisci tenetur rerum suscipit et veritatis. et a laboriosam sequi blanditiis laborum tempore. inventore dolor ullam enim aut fuga quia expedita earum eius ut quia aliquid saepe non sed.

I truly enjoyed what you’ve achieved here. The design is stylish, your written content fashionable, yet you appear to have acquired some apprehension regarding what you intend to present going forward. Undoubtedly, I’ll return more frequently, similar to I have almost constantly, in the event you sustain this ascent.

I sincerely enjoyed what you have produced here. The design is refined, your authored material trendy, yet you appear to have obtained a degree of apprehension regarding what you aim to offer next. Certainly, I shall return more frequently, just as I have been doing almost constantly, provided you uphold this incline.

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.

The breadth of knowledge compiled on this website is astounding. Every article is a well-crafted masterpiece brimming with insights. I’m grateful to have discovered such a rich educational resource. You’ve gained a lifelong fan!

Thank you for your response! I’m grateful for your willingness to engage in discussions. If there’s anything specific you’d like to explore or if you have any questions, please feel free to share them. Whether it’s about emerging trends in technology, recent breakthroughs in science, intriguing literary analyses, or any other topic, I’m here to assist you. Just let me know how I can be of help, and I’ll do my best to provide valuable insights and information!

inventore facilis rem blanditiis omnis cumque mollitia officia ullam quaerat maiores vel perferendis. et praesentium cumque est possimus voluptate temporibus ratione libero dolores id minima eum modi. et enim dignissimos exercitationem autem. dolores voluptas provident optio ea ullam ad iste unde. sapiente consequuntur ipsa magni aliquam laboriosam praesentium.

Top SEO Companies for Small Businesses: A Comprehensive Guide

DMCA kaldırma prosedürü SEO optimizasyonu, dijital pazarlama hedeflerimize ulaşmamıza yardımcı oldu. https://www.royalelektrik.com/istoc-elektrikci/

Great Article bro thanks, situs slot gacor maxwin

Great Article bro, bandar togel resmi

KingBangsat88 Ku Gas Kau Babi

Great Article bro, toto togel bandar togel terpercaya

ümraniye elektrikçi Google SEO ile marka bilinirliğimizi artırdık. http://www.royalelektrik.com/

maltepe elektrikçi Google SEO, arama motoru sonuçlarında görünürlüğümüzü artırdı. https://www.royalelektrik.com/

rejekijitu88

Mahjong ways 2 merupakan situs slot gacor dengan fitur scatter hitam winrate kemenangan tinggi. Daftar dan nikmati fitur jackpot terbesar hari ini!

Reinforced Concrete Pipes in Iraq Elite Pipe Factory offers reinforced concrete pipes that are perfect for handling high loads and severe conditions in infrastructure projects. These pipes are built with advanced reinforcement techniques to ensure durability and reliability. As one of the top manufacturers in Iraq, Elite Pipe Factory guarantees that our reinforced concrete pipes meet all necessary standards and provide exceptional performance. For more information, visit elitepipeiraq.com.

I appreciate you sharing this blog post. Thanks Again. Cool.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Nice post. I learn something totally new and challenging on websites

Hi there to all, for the reason

Ümraniye süpürge performans arttırma Arıza tespiti hızlıydı, süpürgem aynı gün teslim edildi. https://www.guyub.net/read-blog/42261

“I agree with your points, very insightful!”

Wow wonderful blog layout How long have you been blogging for you make blogging look easy The overall look of your site is great as well as the content

Nice blog here Also your site loads up very fast What host are you using Can I get your affiliate link to your host I wish my site loaded up as quickly as yours lol

Your writing has a way of resonating with me on a deep level. It’s clear that you put a lot of thought and effort into each piece, and it certainly doesn’t go unnoticed.

“This is content excellence at its finest! The depth of research and clarity of presentation sets a new standard. Your expertise in this field is truly impressive.”

İstanbul su kaçak tamir servisi Evde Güvende Hissettik: “Çalışanlar oldukça güven vericiydi. Evde rahatlıkla çalıştılar. https://kwave.ai/ustaelektrikci

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.